The most successful eShop is the one where data-based decisions are being made. That is an eShop where it can be calculated how well it’s doing at all times but also which actions work in the shop’s favour. Nowadays there are hundreds of metrics that you can follow. However, only a few of them can capture the state of your business in a valid and direct way. Then, they can turn the data collected into insights that will help you grow.

Although it is very useful to monitor Google Analytics metrics for your online store (sessions, page views, pages / session, etc.), they won’t really help you identify your weaknesses.

Below, we are sharing those metrics that will allow you to have a clear picture of what you are doing right and what wrong. You can also check the progress you have made. Most importantly, these metrics will show you the financial impact of every action or marketing decision you make. You will then be able to optimise the decision-making process in your business.

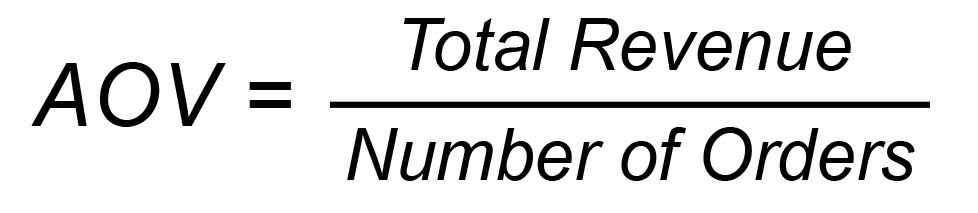

Average Order Value – AOV

It is a simple but very important measurement for monitoring. AOV informs you about the average amount of orders. For example, if you have €100,000 sales in one year and 1,000 completed orders, then your AOV is €100.

The higher the average order amount (AOV) is, the better for your online store. It means that your e-shop generates more revenue from each conversion. Also, a higher AOV usually means higher profit margins for your business.

There are ways to increase the value of each order while enticing your customers with more purchase options, alternative or complementary products. One method often used is free shipping for orders that exceed a certain amount.

Lifetime customer value (LCV) / Life-time value (LTV) metrics

For this basic metric, you need to do the math. LTV helps you calculate what an average customer has spent from the first order until now. Although there are many ways to calculate LTV, here is the easiest way to do so.

The equation has 3 factors: Average Order Value (AOV – the metric we mentioned earlier), the times the average customer buys from your business each year (Purchase frequency) and the average customer relationship lifespan (in years).

Calculating the average customer relationship lifespan is quite easy. You just divide 1 by your churn rate (where churn rate is the rate of customer loss – it is mainly used in subscription services and shows the customers who left within a certain period of time).

Purchase Frequency calculation comes from simply dividing a year’s number of total orders by the year’s number of unique customers.

LTV = Average Order Value Purchase Frequency (in a given year) Average Customer Lifespan

You can improve your LTV with various methods. For example, you can create personalised content, such as emails and promotions on products that your customers have shown interest in. You can even create a loyalty program in order to increase and reward repeated purchases.

Tip: You should always check if LTV> CAC. In order to stay profitable, it should cost you less investing in a customer than the revenue generated over the entire life cycle.

Cost of Customer Acquisition – CAC metric

It is extremely important to know how much you spend to acquire a single customer. The CAC shows exactly that. For example, if you spend €100 to attract 10 customers to your site, your CAC is €10.

Keep in mind that the CAC of the above equation will always be higher than the actual cost of acquiring customers. This happens because the equation does not take into account the part of the marketing spend responsible for the recurring purchases during a particular period.

In any case, the CAC is the most critical metric especially when combined with the LTV mentioned above. The key to a successful business: the Lifetime customer value being higher than the cost of acquiring customers (LTV> CAC). If you can manage this you will have a profitable business in the long run. The ideal is to have an Average Order Value higher than the Customer Acquisition Cost (AOV> CAC). This would mean that you will start earning from the very first sale.

Improving the CAC metric is not a simple process and is directly related to improving promotional efforts in total. It involves a lot of trial and error as you try to figure out which marketing campaigns work and which don’t. The more you focus on your data and improve your marketing accordingly, the better your CAC will be. You can also have a better CAC by improving your targeting, i.e. reaching the ideal customers. The more specific the targeting, the lower the acquisition cost.

So, take out your calculator and good luck!

Join the Discussion